Interest is the price charged to borrow money. Expressed as a rate, interest is a percentage of the amount of money borrowed (the principal amount) that is to be paid for an agreed period of time. Interest can be paid by a borrower to a lender (e.g., to a bank), but it can also be paid by a bank to individuals whose money the bank uses to lend money to other borrowers. In Canada, interest rates are determined by the policy of the Bank of Canada, the demand for loans, the supply of available lending capital, interest rates in the United States, inflation rates and other economic factors. The Bank of Canada helps the Canadian government manage the economy by setting the bank rate and controlling the money supply.

Interest, Credit and Loans

Interest refers to the amount of money that a borrower pays for money borrowed. Interest payments do not reduce the principal amount (the original amount of money borrowed). Interest is usually paid in increments. To calculate the money owed at each increment, a percentage rate or interest rate is set and agreed upon. For example, a $100 loan with a 3 per cent monthly interest rate means that the borrower will owe the lender 3 per cent of the remaining balance of their debt at the end of the payment period. The interest arrangement means that if the borrower continues to owe the full $100 after the first payment period, he or she will be charged $3 in interest and will owe the lender $103. Interest is integral to credit and loan agreements because it allows borrowers to delay repaying the full amount of money they borrowed. Interest also creates an incentive for lenders to release money into circulation.

Credit is a contractual arrangement between a borrower and a lender in which the lender is pre-approved for a loan. The lender provides the borrower with something of value, and the borrower agrees to return that value to the lender at an agreed upon date. In most credit relationships, interest provides incentive for the lender to part with something of value and for the borrower to repay what they owe. Credit repayments can be made either in instalments (e.g., in-store credit) or on a revolving basis (e.g., credit card credit).

Similar to credit, a loan agreement involves a lender providing money, property or anything of value to a borrower. A loan agreement normally has terms agreed upon by both the lender and borrower, including how long the borrower has to repay the lender and how much interest the lender will charge the borrower.

Interest Rates

Interest is stated as a rate (a percentage of the principal amount borrowed) to be charged for either an agreed or indefinite period of time that the money is on loan. The interest rate can be either fixed or variable. Fixed interest rates remain the same for either the entire duration of the loan term or for a specified period of the loan term, while variable interest rates can fluctuate over the loan term.

Three main factors affect interest rates. First, there is a risk that the borrower cannot or will not repay the money. The risk of lending to the federal government is not large (although even countries, or sovereign borrowers, have defaulted on loans), but it rises somewhat on loans to provinces and even more on loans to large companies. On loans to individuals, risk is often reduced by a mortgage on property or collateral (something valuable, such as a bond deposited with the lender as security). The lender can then seize the collateral if the loan is not repaid. Unsecured consumer loans carry a high risk (see Consumer Law), and therefore have high interest rates.

Second, risk increases the longer the money is loaned. The borrower’s ability to repay money may not change much in a month or a year, but over 10 or 20 years it may change radically, as may the need of the lender for the use of their own money.

Third, inflation affects the purchasing power of the money when it is repaid to the lender. For example, on a $100 loan at 5 per cent interest, the lender will lose money if inflation runs at 10 per cent per year because the $105 paid in principal and interest at the end of one year will buy only what about $95 would have bought when the loan was made. The inflation that must be taken into account, however, is not the inflation rate at the time the loan is made or over the year; it is the future rate, which can only be guessed by lender and borrower. If inflation is generally expected to drop, short-term loans may cost more in interest than long-term loans, because the greater risk of default on the longer-term loan is more than balanced by the hope of lower inflation.

In the 1970s and 1980s, economists found that uncertainty also affected interest rates. Real interest rates — that is, the stated rates minus the expected inflation rate — had risen above 8 per cent by 1990, because in a time of economic instability, lenders had attempted to protect themselves from uncertainty.

The general level of interest rates is also affected by the demand for borrowed money, which tends to rise and fall with the economy (see Business Cycles). In times of recession, businesses and consumers are less interested in borrowing, and this tends to reduce the general level of rates. But with economic recovery, businesses want to expand and consumers want to buy on credit, and this increases the demand for loans. Since the financial service reforms of the 1980s and 1990s, increased loan demand has been met by creditors through the selling of debt in the form of asset-backed securities. This process is often referred to as securitization.

History of the Bank Rate in Canada

The Bank of Canada fixes the bank rate, which is the amount it charges for the relatively infrequent loans it makes to the chartered banks. Canada’s central bank was formed by an Act of Parliament in 1934 to help the federal government better manage the national economy.

Until the First World War, almost all Canadian government borrowing took place outside of Canada, in the United Kingdom. The reliance on foreign loans resulted in a lot of volatility in the Canadian economy. After the war, the Canadian government and its chartered banks sought credit within the Canadian market. However, the switch to the Canadian market did not reduce economic volatility. Following the Great Depression, the Canadian government decided to form a central bank to help increase the money supply and generate “cheap money” — a loan, or credit, with a low interest rate. The belief that guided this policy was that cheap money from low bank and interest rates would result in full employment (the lowest possible unemployment rate).

The drive to provide full employment met a serious challenge in the late 1950s, when inflation, or a rise in prices, started to impact the Canadian economy. To confront inflation, Bank of Canada Governor James Coyne ordered a reduction in the Canadian money supply and raised the bank rate.

DID YOU KNOW?

The Bank of Canada fixes the bank rate, which is the amount it charges for the relatively infrequent loans it makes to the chartered banks. The bank rate signals the direction in which the Bank of Canada wants interest rates to move. The Bank of Canada will raise the bank rate to try to reduce inflation, for example, or lower the bank rate to help curb deflation (a decline in money supply — the opposite of inflation).

During the 1970s, the bank rate was fixed at a certain percentage rate for periods that typically lasted for months and then changed by a Bank of Canada announcement. In 1975, Prime Minister Pierre Elliott Trudeau introduced the Anti-Inflation Board, which sought to control wage and price increases. Correspondingly, the Bank of Canada began to try to cut inflation by raising interest rates in 1978 through 1981. This move was based on the theory that with high interest rates, consumers would be unwilling to borrow for goods such as houses and cars, and businesses would be unwilling to invest; thus, a rise in interest rates would cut down the demand for goods and services, which would reduce the upward pressure on prices. This policy (the use of interest rates to cut inflation) culminated in 1981 when the bank rate rose above 21 per cent and the prime lending rate was 22.75 per cent.

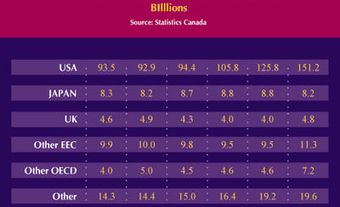

Canadian rates might not have reached such levels had it not been for the rise in rates in the United States, where a similar monetarist policy was in effect (see Monetary Policy). When American rates rise and Canadian rates do not follow, money tends to flow to the US as lenders seek the higher return on their loans. This outflow pushes the value of the Canadian dollar down relative to the value of other foreign currencies, such as the American dollar. Imported goods then cost more in Canadian dollars (see Imports), and this tends to raise the inflation rate in Canada. One way to break the close connection between Canadian and American interest rates is to control the flow of money in and out of Canada, as was done during the Second World War by a system of exchange controls (see Exchange Rates).

Overnight Rate

The overnight rate refers to the interest rate used by large banks in the overnight market to lend and borrow from each other. In Canada, the Bank of Canada sets a target rate for the overnight rate, which it refers to as the policy interest rate. In March 1980, the Bank of Canada shifted to a system under which the bank rate was changed each week to match changes in the rate paid by the federal government to borrow money for 90 days by selling treasury bills. In February 1996, the Bank of Canada adopted a new approach. It began setting the bank rate at the upper limit on a one-half-percentage-point range (e.g., 0.75 per cent to 1.25 per cent) for overnight loans to financial institutions — over which it has more control than the rate on 90-day treasury bills. The range, or operating band, is fixed by the bank and is only adjusted when the bank wants a change in other short-term rates, such as for consumer and business loans. For example, the bank rate was changed five times in 1998. At the end of 1998, the bank rate was 5.25 per cent, which was the top of the 4.75 to 5.25 per cent operating band. Other lenders, usually, quickly match changes in the bank rate with increases or decreases in their prime rates, to which consumer and business loans are tied. In November 2000, the Bank of Canada announced that it planned to introduce eight fixed dates each year to announce changes to the overnight rate. Fixed announcements of possible interest rate changes ensure less speculation about a rate that affects not only large banks, but consumer loan and mortgage rates, as well as the exchange rate for the Canadian dollar.

See also Banking; Economics; Economy.

Share on Facebook

Share on Facebook Share on X

Share on X Share by Email

Share by Email Share on Google Classroom

Share on Google Classroom