The Caisse de dépôt et placement du Québec (CDPQ) was established by an act of the National Assembly on 15 July 1965. The CDPQ was created to manage funds deposited by the Québec Pension Plan (QPP), a public insurance plan similar to the Canadian Pension Plan (CPP). The CDPQ is a global investment group with 10 international offices. As of 30 June 2021 the CDPQ’s net assets totaled $390 billion.

Mandate

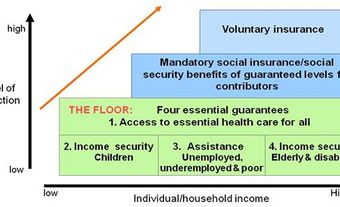

The Caisse de dépôt et placement du Québec (CDPQ) was created by the National Assembly on 15 July 1965 with the mandate to manage funds deposited by the Québec Pension Plan (QPP), the province's public insurance plan. The number of depositor groups to the CDPQ have grown steadily since its foundation and currently include of 42 depositor groups. These groups consist primarily of public and parapublic pension funds and insurance plans.

The legal mandate of the CDPQ is to increase the assets of depositors, a responsibility that it has traditionally sought to fulfil while promoting economic development in Quebec. In general, it has been successful in meeting this dual objective, with performance comparing favourably to the Canada Pension Plan (CPP), and, frequently, to other Canadian institutional portfolios and standard reference indices.

Portfolio

The early investments of the CDPQ were essentially comprised of Quebec and Hydro-Québec bonds, a portion of which served as key backing for hydroelectric development in Churchill Falls, Labrador. In 1997, its incorporating act was modified to allow the majority of its assets under management to be invested in equities.

To maximize yield, the CDPQ has established multiple subsidiaries specializing in investments in open and closed-capital companies in communications, new technologies, small business and large corporations and real estate. Due to its size, the CDPQ is increasingly turning to foreign investment and has opened 10 international offices to seek out the best investment prospects. As of 30 June 2021, the CDPQ’s net assets totaled $390 billion.

Share on Facebook

Share on Facebook Share on X

Share on X Share by Email

Share by Email Share on Google Classroom

Share on Google Classroom